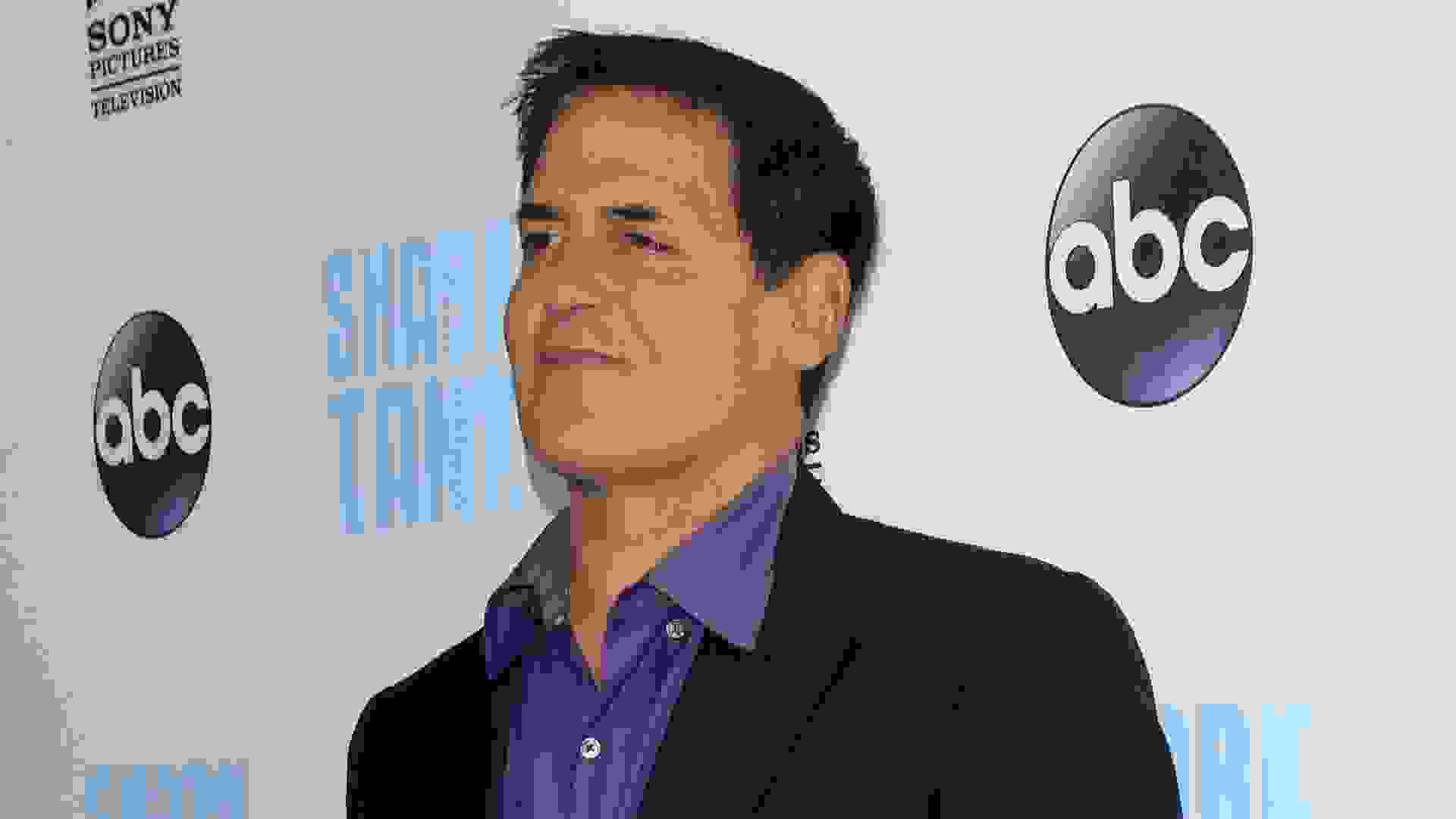

How Did Mark Cuban Get His Money?

twenty Genius Things Mark Cuban Says To Do With Your Coin

Learn how you lot can be a maverick with your money like Mark Cuban.

1. Be a Little Scrap of a Risk Taker

Talk to any self-made millionaires or billionaires and they might preach the importance of taking calculated risks. Sometimes, risks and rewards go hand-in-hand, as Cuban pointed out in a 2017 interview with Coin magazine while discussing the value of investing your savings. He explained that information technology'southward possible to save a million dollars, but only if y'all're disciplined and accept risks. Many who accomplish higher levels of financial success aren't afraid to invest for the betterment of their futurity — whether they're investing in the market, a business or their pedagogy.

POLL: Does Apr's Stock Market Dip Concern You?

2. But Merely Invest Upwardly To 10% in Risky Investments

If you practice have risks in the investment realm, limit the amount you contribute.

"If you're a true adventurer and you really want to throw the Hail Mary, you might take 10% and put it in bitcoin or Ethereum, but if you lot do that, you lot've got to pretend you've already lost your money," Cuban told Vanity Fair. "It'due south like collecting fine art, it's like collecting baseball game cards, it's like collecting shoes — something's worth what somebody else would pay for information technology. I'd limit (risky investments) to 10%."

3. Put It in the Bank

In an exclusive interview with Immature Money, a personal finance instruction and media company, Cuban offered this general investing advice and then followed the statement by maxim, "The idiots that tell you to put your money in the market because somewhen it volition go upwards need to tell you lot that because they are trying to sell you something. The stock market is probably the worst investment vehicle out there."

Although some investors believe the stock market place is the ticket to wealth, others believe the market is too risky and volatile. Your stock can be profitable i mean solar day, yet information technology just takes one downturn to lose information technology all. Rather than put all your eggs in the stock market place, Cuban encourages keeping some money in a savings account for a rainy day so you lot're protected if something goes wrong. In his own words, "Buy-and-hold is a sucker's game … Those who put their coin in CDs sleep well at dark and definitely accept more than money today than they did yesterday."

4. Salvage 6 Months of Income

Aim to have six months worth of income saved in that banking company account, Cuban told Vanity Fair.

"If you don't like your job at some point or you get fired or yous have to movement or something goes wrong, you're going to need at to the lowest degree 6 months income," he said.

5. Detect a Way To Invest Inexpensively in the Market

If you want to dabble in the market, Cuban advises doing and then safely to minimize your gamble. In his chat with Coin, he suggested investing in a depression-cost mutual fund. These are investments that let you pool your assets with the assets of other investors, which provides a cheaper manner to diversify your portfolio. As Cuban puts it: "If you tin discover a way to invest inexpensively in the market, y'all tin can start to build your net worth."

6. If Yous Don't Fully Understand the Risks of an Investment You're Considering, It's OK To Do Zip

Cuban gave this advice in a blog on his site titled "The Best Investment Advice You Will Ever Become." Although investing tin build your net worth and put you lot on the path toward financial freedom, at that place's no guarantee that an investment strategy will pay off.

Earlier investing, brand sure you know the risks and set up for the possibility of losing money. If you take doubts — or if in that location'due south too much uncertainty surrounding an investment — in that location's zip incorrect with holding onto your cash until the right opportunity comes forth.

7. Don't Let Fear Exist a Roadblock

Cuban shared this statement in his book "How to Win at the Sport of Business organisation: If I Tin Do It, You lot Can Do It." Fear is a natural feeling, but it's also ane of the worst enemies to success. If you desire to become alee, go out of your own way and stop hiding behind fright — it keeps you lot stuck in the same place and stifles growth.

If investing is new to you, fright and anticipation are normal. Rather than permit it hold yous back, educate yourself on different investment strategies to build your confidence — when you are ready, offset with cheaper, safer investments.

8. Be a Smart Shopper

There'south a definite connexion between being a smart shopper and a savvy investor. In one of Marker Cuban'due south blog posts on the best investment advice, he explains how cash creates transitional returns. He encourages analyzing how much you spend over the form of a yr and and so suggested taking advantage of greenbacks, quantity and discounts to get a amend render on your coin. In other words — it'due south best to purchase in bulk.

"Saving 15% on $1,000 worth of items you know you will admittedly spend money on is a better return on your money than making fifteen% in a year on a $1,000 investment because you don't pay taxes on it," said Cuban.

9. Rarely Have Third-Party Advice on Investments

Cuban isn't afraid to march to the crush of his ain drum, particularly when it comes to his money and investing. In an interview with Forbes, Cuban stated he rarely takes 3rd-party communication on his investments, thus underscoring an important indicate: Don't put all your trust in someone else.

This doesn't mean you shouldn't seek guidance from financial advisors. Their insight is invaluable when you're just starting out and accept express investment noesis. At the aforementioned fourth dimension, don't give someone complete control over where your money goes. Larn the ins and outs of investing for yourself then yous can have a say in how you invest your money. If yous're but starting out, pick up a book to start learning.

10. Go To the Cheapest School Possible for Your Freshman — and Maybe Sophomore — Classes

College can be an fantabulous investment in your hereafter and provide the skills and knowledge you lot need to better your financial outlook — simply acquiring said knowledge isn't without costs. Cuban offers a cheaper approach: Enroll in a local or community college for the first couple of years of your undergraduate teaching. Some might fence for the benefits of attending a prestigious school, but Cuban encourages young people to go to a schoolhouse they can actually afford.

"The near important criteria when choosing a college is affordability," he tweeted in May 2019. "A community college that offers transferable credits is e'er smart. There isn't a lot of value add from big-proper noun schools for freshman or sophomore classes, particularly when a motivated student tin can augment their studies with free online courses from the big names."

11. Take Disciplined Spending

Cuban knows a matter or two nigh being disciplined and living frugally — afterward higher, he moved into a firm with five roommates, lived off macaroni and cheese, and collection an older vehicle. Rather than invest in expensive belongings, he invested in himself and his future goals. Likewise, a frugal mindset can propel yous toward your goals. If you make money and build a nest egg, you'll have the resources needed to make smart investments.

Alive beneath your ways and reduce spending to help build your savings. Consider driving an older car, buying secondhand goods, living with your parents a trivial longer or getting a roommate to lower housing expenses.

12. Pay Off Credit Cards After 30 Days — or Don't Employ Them at All

Credit cards serve a useful purpose, only they can also lead to debt if y'all don't manage them responsibly, which is why Cuban gave this advice to consumers. He doesn't discourage using a credit menu, but he does encourage paying off balances in full every month to avoid wasting coin on interest.

"Using a credit menu is OK if you pay it off at the end of the calendar month," Cuban said in an interview with Money. "Just recognize that the 18% or twenty% or 30% you're paying in credit bill of fare debt is going to cost you lot a lot more than you ever could earn anywhere else."

13. If Yous Accept Credit Card Debt — or Any Debt — Pay It Off Earlier Making Other Investments

"The all-time investment yous tin make is paying off your credit cards, paying off whatever debt you lot have," Cuban told MarketWatch. "If yous have a educatee loan with a 7% interest charge per unit, if you pay off that loan, you're making 7%, that's your immediate return, which is a lot safer than picking a stock, or trying to pick existent estate, or whatever it may be."

14. Negotiate Using Cash

Cuban has long preached that greenbacks is king, and he told Vanity Fair that having cash available can ultimately salve you money.

"I tell people all the fourth dimension, if you're out, you're going to take a yoga class, and they want to charge you $30, say, 'Wait, I got $xx.' You know what? They're going to accept it," he told Vanity Off-white. "Negotiating with greenbacks is a far improve mode to get a return on your investment."

xv. Books Are Always a Good Investment

Although Cuban is an advocate of living cheaply and saving every bit much as possible, he believes that a good volume is the i thing that's e'er worth the money.

"I used to beloved to walk through bookstores when there were bookstores everywhere, and if at that place was something that caught my eye, and I thought it could requite me ane idea, to spend $thirty to get one thought that could help propel me, make my businesses better — it was a bargain," he told Vanity Fair.

1 book that got Cuban "all fired up" is "The Only Investment Guide You'll Ever Need" by Andrew Tobias, he said. "I'll read hours every day because all it takes is 1 picayune matter to propel you to the next level."

sixteen. Proceed Your Money to Yourself

Cuban doesn't seem to believe the onetime aphorism, "Sharing is caring." In an interview with The Dallas Morning News, he advised potential lottery winners to recollect twice before lending money to anyone. His advice is applicative to anyone who comes across a financial windfall.

"Tell all your friends and relatives 'no,'" Cuban said. "They will ask. Tell them 'no.' If y'all are close to them, you already know who needs help and what they demand. Feel free to help some, only talk to your accountant before you practice annihilation. And remember this: No one needs $1 million dollars for anything. No one needs $100,000 for anything. Anyone who asks is not your friend."

17. Don't Make Rash Money Moves Based on Marketplace Fluctuations

The coronavirus pandemic has wreaked havoc on the markets — only Cuban said that this is not a fourth dimension to panic.

"Remember the market is where it was less than a twelvemonth agone," he shared on LinkedIn. "No one freaked out when it went up likewise fast. No reason to freak out when information technology goes down quickly. Remember, I follow the No. 1 rule of investing: When you don't know what to do, do zippo."

18. Avert Taking Out Bank Loans

Cuban is passionate about avoiding debt, whether information technology'south credit menu debt or a loan from the banking company. If you want to start your own business, he recommends doing it without relying on depository financial institution loans.

"If y'all have a loan, you are no longer the boss," he told Dave Ramsey. "And your customers are no longer the bosses. Your banker is the boss. And if you hit whatever adversity, like every startup does, the priority becomes taking intendance of your broker… You're no longer in a position to do whatever it takes to survive."

19. Use Your Money To Buy Fourth dimension

"I value my time a lot more than my next dollar," Cuban told Barbara Corcoran on her podcast, "888-Barbara."

That's why he doesn't mind spending his money on "things that buy time" — which for him meant buying a individual jet, but for the average person, this can hateful paying actress for piffling conveniences such equally pre-chopped vegetables or hiring a cleaning service and then you have more than time to spend with family unit.

"I can make things happen more quickly past paying a little fleck more," he said. "And that'south important, considering fourth dimension is the i asset yous can't own, buy or get back."

20. Refinance Debt When Interest Rates Are Low

Nearly the Author

Source: https://www.gobankingrates.com/net-worth/business-people/things-mark-cuban-says-do-with-money/

Posted by: taylorwhovestaken.blogspot.com

0 Response to "How Did Mark Cuban Get His Money?"

Post a Comment