How Does The Money Demand Curve Affect Other Areas Of The Economy?

Chapter 4. Labor and Fiscal Markets

iv.2 Need and Supply in Financial Markets

Learning Objectives

By the cease of this section, you will be able to:

- Identify the demanders and suppliers in a fiscal market.

- Explain how interest rates can touch supply and demand

- Analyze the economical furnishings of U.S. debt in terms of domestic financial markets

- Explain the role of price ceilings and usury laws in the U.S.

United States' households, institutions, and domestic businesses saved about $i.9 trillion in 2013. Where did that savings go and what was information technology used for? Some of the savings ended up in banks, which in turn loaned the money to individuals or businesses that wanted to infringe money. Some was invested in private companies or loaned to regime agencies that wanted to borrow money to raise funds for purposes like building roads or mass transit. Some firms reinvested their savings in their ain businesses.

In this department, nosotros will determine how the demand and supply model links those who wish to supply financial capital (i.e., savings) with those who need fiscal capital (i.e., borrowing). Those who save money (or make financial investments, which is the same thing), whether individuals or businesses, are on the supply side of the financial market place. Those who infringe money are on the demand side of the fiscal market. For a more detailed handling of the different kinds of fiscal investments like bank accounts, stocks and bonds, see the Fiscal Markets chapter.

Who Demands and Who Supplies in Financial Markets?

In any market, the price is what suppliers receive and what demanders pay. In financial markets, those who supply financial capital letter through saving look to receive a charge per unit of return, while those who demand financial capital by receiving funds look to pay a rate of return. This rate of return can come in a variety of forms, depending on the type of investment.

The simplest case of a charge per unit of render is the interest rate. For instance, when yous supply money into a savings account at a banking company, you receive interest on your deposit. The interest paid to you lot as a per centum of your deposits is the interest charge per unit. Similarly, if you demand a loan to purchase a car or a estimator, you lot volition need to pay involvement on the money you lot infringe.

Allow'due south consider the marketplace for borrowing money with credit cards. In 2014, virtually 200 million Americans were cardholders. Credit cards allow you to borrow money from the card's issuer, and pay dorsum the borrowed amount plus interest, though almost allow you a menstruum of time in which yous tin repay the loan without paying interest. A typical credit card involvement rate ranges from 12% to 18% per yr. In 2014, Americans had about $793 billion outstanding in credit carte du jour debts. About half of U.S. families with credit cards written report that they almost e'er pay the total rest on time, only one-quarter of U.S. families with credit cards say that they "hardly always" pay off the card in full. In fact, in 2014, 56% of consumers carried an unpaid balance in the terminal 12 months. Let's say that, on boilerplate, the almanac interest rate for credit carte borrowing is xv% per year. And then, Americans pay tens of billions of dollars every year in interest on their credit cards—plus bones fees for the credit card or fees for late payments.

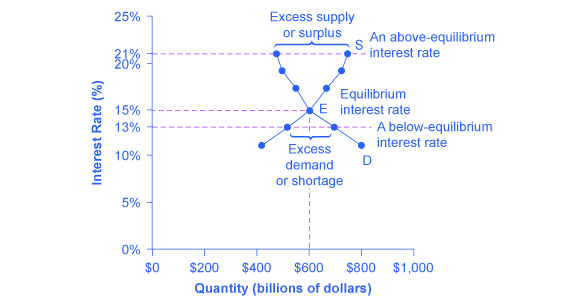

Figure 1 illustrates demand and supply in the financial market for credit cards. The horizontal axis of the fiscal market shows the quantity of money that is loaned or borrowed in this marketplace. The vertical or toll axis shows the rate of return, which in the instance of credit card borrowing can exist measured with an involvement rate. Table five shows the quantity of fiscal capital that consumers demand at various involvement rates and the quantity that credit card firms (often banks) are willing to supply.

| Involvement Rate (%) | Quantity of Fiscal Uppercase Demanded (Borrowing) ($ billions) | Quantity of Financial Capital Supplied (Lending) ($ billions) |

|---|---|---|

| eleven | $800 | $420 |

| thirteen | $700 | $510 |

| xv | $600 | $600 |

| 17 | $550 | $660 |

| 19 | $500 | $720 |

| 21 | $480 | $750 |

| Table 5. Demand and Supply for Borrowing Money with Credit Cards | ||

The laws of demand and supply continue to apply in the fiscal markets. According to the law of need, a higher charge per unit of return (that is, a higher toll) will decrease the quantity demanded. Every bit the interest rate rises, consumers volition reduce the quantity that they borrow. According to the law of supply, a higher price increases the quantity supplied. Consequently, as the interest rate paid on credit card borrowing rises, more firms will exist eager to result credit cards and to encourage customers to use them. Conversely, if the involvement rate on credit cards falls, the quantity of financial capital supplied in the credit carte marketplace will decrease and the quantity demanded will autumn.

Equilibrium in Financial Markets

In the financial market place for credit cards shown in Figure 1, the supply curve (S) and the demand curve (D) cross at the equilibrium point (E). The equilibrium occurs at an interest charge per unit of 15%, where the quantity of funds demanded and the quantity supplied are equal at an equilibrium quantity of $600 billion.

If the interest charge per unit (remember, this measures the "cost" in the financial market) is above the equilibrium level, then an excess supply, or a surplus, of financial capital will ascend in this market. For example, at an interest charge per unit of 21%, the quantity of funds supplied increases to $750 billion, while the quantity demanded decreases to $480 billion. At this in a higher place-equilibrium interest charge per unit, firms are eager to supply loans to credit card borrowers, merely relatively few people or businesses wish to infringe. Equally a outcome, some credit card firms will lower the interest rates (or other fees) they charge to attract more business concern. This strategy volition push the involvement rate down toward the equilibrium level.

If the involvement rate is beneath the equilibrium, so excess need or a shortage of funds occurs in this market. At an interest rate of 13%, the quantity of funds credit card borrowers demand increases to $700 billion; but the quantity credit card firms are willing to supply is just $510 billion. In this state of affairs, credit carte firms will perceive that they are overloaded with eager borrowers and conclude that they have an opportunity to raise involvement rates or fees. The interest charge per unit volition face economical pressures to creep upwardly toward the equilibrium level.

Shifts in Demand and Supply in Financial Markets

Those who supply financial uppercase face ii broad decisions: how much to save, and how to divide upwardly their savings among unlike forms of financial investments. We will talk over each of these in turn.

Participants in fiscal markets must decide when they adopt to consume goods: now or in the future. Economists call this intertemporal decision making because it involves decisions across time. Different a determination about what to buy from the grocery store, decisions about investment or saving are made beyond a period of fourth dimension, sometimes a long period.

Most workers relieve for retirement considering their income in the nowadays is greater than their needs, while the opposite will be true once they retire. So they save today and supply financial markets. If their income increases, they salvage more. If their perceived situation in the time to come changes, they alter the amount of their saving. For example, in that location is some evidence that Social Security, the program that workers pay into in social club to authorize for government checks afterward retirement, has tended to reduce the quantity of financial capital letter that workers salve. If this is true, Social Security has shifted the supply of financial uppercase at whatever involvement rate to the left.

Past contrast, many higher students need money today when their income is low (or nonexistent) to pay their college expenses. As a result, they borrow today and demand from financial markets. Once they graduate and become employed, they will pay back the loans. Individuals borrow money to buy homes or cars. A concern seeks financial investment so that it has the funds to build a manufacturing plant or invest in a research and evolution projection that will non pay off for 5 years, ten years, or even more. So when consumers and businesses have greater confidence that they will exist able to repay in the future, the quantity demanded of financial capital at any given interest rate will shift to the correct.

For instance, in the technology boom of the belatedly 1990s, many businesses became extremely confident that investments in new applied science would accept a high rate of return, and their demand for financial capital shifted to the right. Conversely, during the Keen Recession of 2008 and 2009, their need for financial capital at whatsoever given interest charge per unit shifted to the left.

To this point, we have been looking at saving in total. At present let usa consider what affects saving in dissimilar types of financial investments. In deciding between different forms of financial investments, suppliers of financial capital volition have to consider the rates of return and the risks involved. Rate of return is a positive aspect of investments, merely gamble is a negative. If Investment A becomes more risky, or the return diminishes, then savers volition shift their funds to Investment B—and the supply curve of financial majuscule for Investment A volition shift back to the left while the supply curve of capital for Investment B shifts to the right.

The Us as a Global Borrower

In the global economy, trillions of dollars of financial investment cross national borders every year. In the early 2000s, financial investors from foreign countries were investing several hundred billion dollars per year more in the U.S. economic system than U.Due south. fiscal investors were investing abroad. The following Work It Out deals with one of the macroeconomic concerns for the U.S. economy in contempo years.

The Event of Growing U.S. Debt

Imagine that the U.Southward. economy became viewed every bit a less desirable place for foreign investors to put their money because of fears nearly the growth of the U.S. public debt. Using the 4-stride process for analyzing how changes in supply and demand affect equilibrium outcomes, how would increased U.Due south. public debt bear upon the equilibrium price and quantity for capital in U.Due south. financial markets?

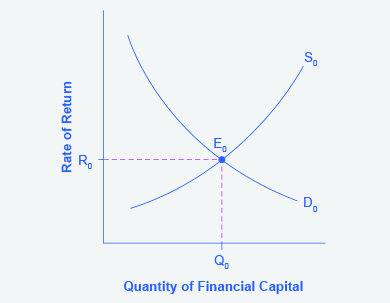

Step one. Depict a diagram showing demand and supply for financial upper-case letter that represents the original scenario in which foreign investors are pouring money into the U.S. economy. Figure 2 shows a demand curve, D, and a supply bend, S, where the supply of upper-case letter includes the funds arriving from strange investors. The original equilibrium E0 occurs at interest rate R0 and quantity of financial investment Q0.

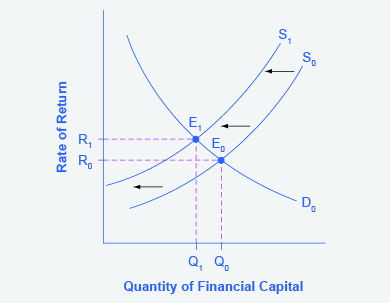

Step 2. Volition the macerated confidence in the U.Due south. economic system every bit a place to invest impact need or supply of financial capital? Yep, it volition touch supply. Many foreign investors await to the U.S. financial markets to store their money in safe financial vehicles with depression risk and stable returns. As the U.S. debt increases, debt servicing will increase—that is, more current income volition exist used to pay the interest rate on past debt. Increasing U.Southward. debt likewise means that businesses may have to pay college interest rates to borrow coin, considering concern is now competing with the regime for fiscal resources.

Step 3. Will supply increase or subtract? When the enthusiasm of foreign investors' for investing their money in the U.S. economy diminishes, the supply of financial capital shifts to the left. Figure 3 shows the supply curve shift from Due south0 to Southane.

Step 4. Thus, strange investors' diminished enthusiasm leads to a new equilibrium, Eane, which occurs at the college interest rate, R1, and the lower quantity of financial investment, Q1.

The economy has experienced an enormous inflow of strange capital. According to the U.S. Bureau of Economic Analysis, by the third quarter of 2014, U.S. investors had accumulated $24.6 trillion of strange assets, but strange investors owned a total of $thirty.8 trillion of U.S. assets. If foreign investors were to pull their money out of the U.Due south. economic system and invest elsewhere in the earth, the result could be a significantly lower quantity of financial investment in the U.s., bachelor only at a higher interest rate. This reduced inflow of foreign financial investment could impose hardship on U.South. consumers and firms interested in borrowing.

In a modernistic, developed economy, financial upper-case letter oft moves invisibly through electronic transfers between one bank account and another. Yet these flows of funds can be analyzed with the aforementioned tools of need and supply every bit markets for appurtenances or labor.

Price Ceilings in Fiscal Markets: Usury Laws

As we noted earlier, about 200 million Americans own credit cards, and their interest payments and fees total tens of billions of dollars each year. It is piddling wonder that political pressures sometimes arise for setting limits on the interest rates or fees that credit card companies charge. The firms that issue credit cards, including banks, oil companies, phone companies, and retail stores, reply that the higher interest rates are necessary to cover the losses created by those who borrow on their credit cards and who do not repay on fourth dimension or at all. These companies as well point out that cardholders tin can avoid paying interest if they pay their bills on time.

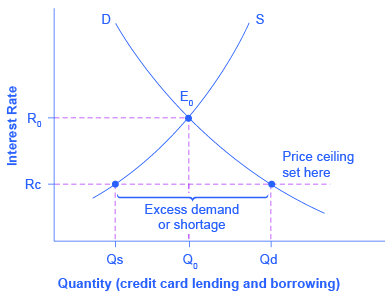

Consider the credit bill of fare marketplace as illustrated in Figure 4. In this financial market, the vertical axis shows the involvement charge per unit (which is the price in the fiscal market). Demanders in the credit card market place are households and businesses; suppliers are the companies that issue credit cards. This figure does not use specific numbers, which would be hypothetical in any example, only instead focuses on the underlying economic relationships. Imagine a police imposes a price ceiling that holds the involvement rate charged on credit cards at the rate Rc, which lies below the involvement charge per unit R0 that would otherwise have prevailed in the market. The price ceiling is shown by the horizontal dashed line in Effigy 4. The demand and supply model predicts that at the lower toll ceiling interest rate, the quantity demanded of credit card debt volition increase from its original level of Q0 to Qd; however, the quantity supplied of credit card debt will decrease from the original Q0 to Qs. At the toll ceiling (Rc), quantity demanded volition exceed quantity supplied. Consequently, a number of people who want to have credit cards and are willing to pay the prevailing interest rate will observe that companies are unwilling to event cards to them. The upshot will exist a credit shortage.

Many states do have usury laws, which impose an upper limit on the interest rate that lenders can charge. However, in many cases these upper limits are well above the marketplace interest charge per unit. For example, if the interest rate is not allowed to rising to a higher place xxx% per year, it can withal fluctuate below that level co-ordinate to market forces. A price ceiling that is prepare at a relatively loftier level is nonbinding, and it will have no applied result unless the equilibrium price soars high plenty to exceed the cost ceiling.

Cardinal Concepts and Summary

In the demand and supply analysis of financial markets, the "price" is the rate of return or the interest rate received. The quantity is measured by the money that flows from those who supply financial capital letter to those who need it.

2 factors can shift the supply of financial capital to a certain investment: if people want to alter their existing levels of consumption, and if the riskiness or return on ane investment changes relative to other investments. Factors that can shift demand for capital letter include business organisation confidence and consumer confidence in the future—since financial investments received in the present are typically repaid in the future.

Self-Check Questions

- In the financial marketplace, what causes a movement forth the demand curve? What causes a shift in the demand bend?

- In the financial market, what causes a movement along the supply curve? What causes a shift in the supply curve?

- If a usury law limits interest rates to no more than 35%, what would the probable impact be on the corporeality of loans made and involvement rates paid?

- Which of the post-obit changes in the financial market will lead to a turn down in interest rates:

- a rising in demand

- a fall in demand

- a rising in supply

- a fall in supply

- Which of the following changes in the financial market will pb to an increase in the quantity of loans made and received:

- a ascension in demand

- a fall in demand

- a rise in supply

- a fall in supply

Review Questions

- How is equilibrium defined in fiscal markets?

- What would be a sign of a shortage in financial markets?

- Would usury laws help or hinder resolution of a shortage in financial markets?

Critical Thinking Questions

- Suppose the U.S. economy began to grow more rapidly than other countries in the world. What would be the likely bear upon on U.South. financial markets as part of the global economy?

- If the government imposed a federal interest charge per unit ceiling of xx% on all loans, who would gain and who would lose?

Problems

- Predict how each of the following economic changes will impact the equilibrium price and quantity in the financial market for home loans. Sketch a demand and supply diagram to support your answers.

- The number of people at the near common ages for abode-buying increases.

- People proceeds confidence that the economy is growing and that their jobs are secure.

- Banks that accept fabricated domicile loans detect that a larger number of people than they expected are not repaying those loans.

- Because of a threat of a war, people become uncertain about their economic future.

- The overall level of saving in the economy diminishes.

- The federal government changes its bank regulations in a way that makes information technology cheaper and easier for banks to make dwelling loans.

- Table half dozen shows the amount of savings and borrowing in a market for loans to purchase homes, measured in millions of dollars, at various interest rates. What is the equilibrium interest rate and quantity in the capital financial market? How can you lot tell? Now, imagine that considering of a shift in the perceptions of foreign investors, the supply bend shifts and so that there will exist $10 million less supplied at every interest rate. Summate the new equilibrium interest rate and quantity, and explicate why the direction of the interest rate shift makes intuitive sense.

Interest Charge per unit Qs Qd 5% 130 170 6% 135 150 7% 140 140 viii% 145 135 9% 150 125 10% 155 110 Table 6. Loans to Buy Homes at Various Involvement Rates

References

CreditCards.com. 2013. http://www.creditcards.com/credit-card-news/credit-bill of fare-industry-facts-personal-debt-statistics-1276.php.

Glossary

- interest rate

- the "price" of borrowing in the financial market; a charge per unit of return on an investment

- usury laws

- laws that impose an upper limit on the interest rate that lenders can accuse

Solutions

Answers to Self-Bank check Questions

- Changes in the interest charge per unit (i.e., the price of financial capital) cause a motility along the demand curve. A modify in annihilation else (non-price variable) that affects demand for financial capital (due east.g., changes in confidence almost the future, changes in needs for borrowing) would shift the demand curve.

- Changes in the interest charge per unit (i.e., the price of financial capital) cause a movement along the supply curve. A change in annihilation else that affects the supply of financial capital (a non-price variable) such as income or futurity needs would shift the supply curve.

- If market interest rates stay in their normal range, an interest charge per unit limit of 35% would not be bounden. If the equilibrium interest rate rose above 35%, the interest rate would exist capped at that rate, and the quantity of loans would be lower than the equilibrium quantity, causing a shortage of loans.

- b and c will lead to a fall in involvement rates. At a lower demand, lenders will not be able to charge every bit much, and with more bachelor lenders, contest for borrowers volition drive rates downwardly.

- a and c will increment the quantity of loans. More than people who want to infringe will event in more loans being given, as will more people who want to lend.

Source: https://opentextbc.ca/principlesofeconomics/chapter/4-2-demand-and-supply-in-financial-markets/

Posted by: taylorwhovestaken.blogspot.com

0 Response to "How Does The Money Demand Curve Affect Other Areas Of The Economy?"

Post a Comment